Take one step closer to sovereignty every single week, join the DeFi Slate community below:

Spotify | YouTube | iTunes | R.S.S. Feed

High Rollers:

It may sound surprising, but investing in crypto is still far too risky for many investors and market participants. More specifically, the risk here is directional risk.

Directional risk is a risk of loss which arises from exposure to the particular assets of a market. In this case, the risk of crypto dropping in price prevents people from using crypto.

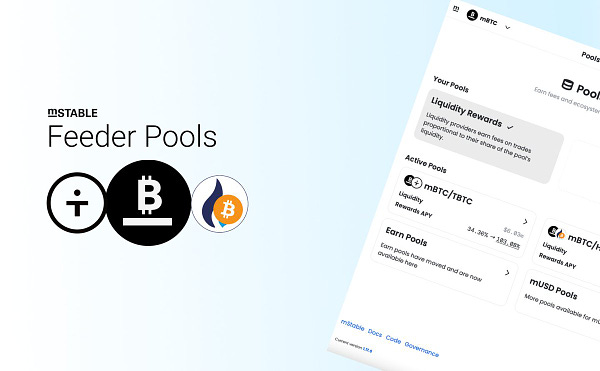

mStable is here to solve this issue. Remember stablecoins, like mUSD, are pegged to the US Dollar, so those who hold stablecoins do not have a risk of their assets losing value.

mStable’s Earn product, they provide a consistent yield to those who collateralize stablecoins. With mStable’s machinery, non-crypto users have the ability to extract all the benefits of crypto without taking on the risks.

We talk about stablecoins, yield, and much more in EP28 with James from mStable!

-Rob

🙏 Big Ups To Our Great Sponsor Aave: Earn Interest & Leverage Your Assets with Aave, a non-custodial money market protocol leading the #DeFi charge.

Shoutout to Frontier.xyz: A Chain-Agnostic DeFi Aggregation Layer Bringing DeFi To The Masses Via Their Mobile App, Download it Now!

🎙DeFi By Design EP #28: Creating Stable Yield on Composable Assets w James Simpson

Recent Tweets from mStable:

👀 Sponsor Update: mStable provides an autonomous and non-custodial infrastructure for pegged-value crypto assets. Earn maximal APY on mUSD and mBTC by collecting fees generated on lending protocols!

It’s harvest season. Farm like a pro on mstable :)

⚠️ DISCLAIMER: Investing into cryptocurrency and DeFi platforms comes with inherent risk including technical risk, human error, platform failure and more. At certain points throughout this post, we might get commission for promoting certain projects, if this is the case we will always make sure it is clear. We are strictly an educational content platform, nothing we offer is financial advice. We are not professionals or licensed advisors.

Liked this post? Share with a friend :)

Subscribe to The Rollup Newsletter & join thousands of other crypto enthusiasts:

🎙DeFi By Design EP #28: Creating Stable Yield on Composable Assets w James Simpson